north carolina estate tax 2020

Up to 25 cash back However now that North Carolina has eliminated its estate tax most wealthy North Carolina residents will owe estate taxes only to the federal. Owner or Beneficiarys Share of NC.

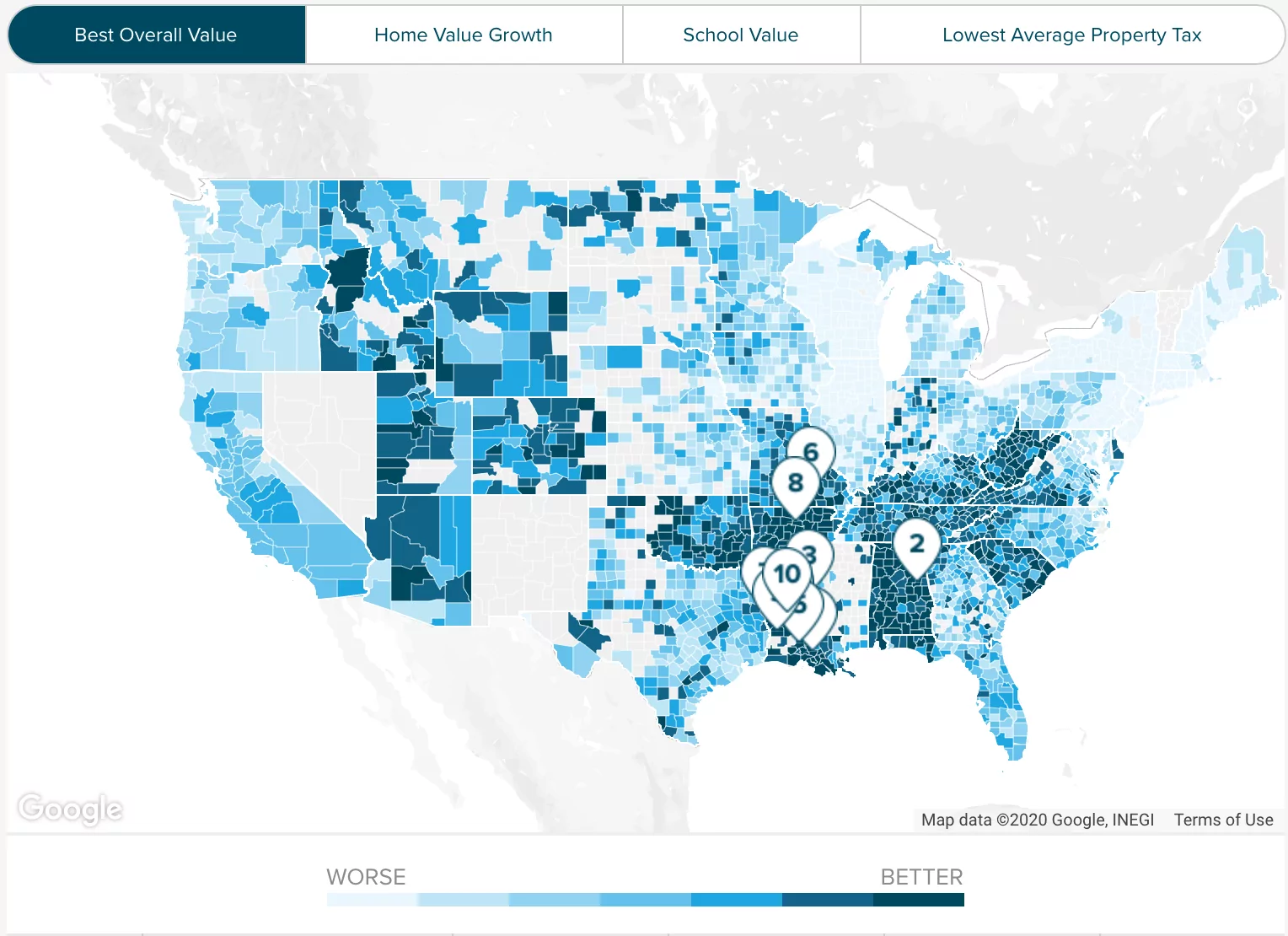

Real Estate Property Tax Data Charleston County Economic Development

2020 D-407A Instructions for Estates and Trusts Income Tax Return.

. Pritzkers Family Relief Plan also includes several tax holidays and rebates including a suspension of the states sales tax on groceries from July 1 2022. Just click on a city name to view the estate sales and auctions that are being. WASHINGTON The Internal Revenue Service today reminds taxpayers who requested an extension to file their 2021 tax return to do so by Monday October 17.

North carolina may have more current or accurate information. Even though north carolina has neither an estate tax or nor an. Complete this version using your computer to enter the required information.

7A-307a7 to create a. Session Law 2020-60 amended GS. In North Carolina both long- and short-term capital gains are treated as regular income which means the 525 flat income tax rate.

Current Federal Estate Tax Exemption. 2020 D-407 Estates and Trusts Income Tax Return Files 2020-D407-webfillpdf Webfill version. North Carolina Estate Tax 2020.

On july 23 2013 the governor signed hb 998 which repealed the north carolina estate tax retroactively to january 1 2013. 105-321 - Repealed by Session Laws 2013-316 s7a effective January 1 2013 and applicable to. For Tax Year 2019 For Tax Years.

North Carolina Capital Gains Tax. 2020 North Carolina General Statutes Chapter 105 - Taxation Article 1A - Estate Taxes. Any assets in excess of the estate tax exemption are subject to estate taxes as the estate tax rates in effect as of the date of the decedents death.

Beneficiarys Share of North Carolina Income Adjustments and Credits. During the 2020 short session the General Assembly enacted one change affecting estates costs and fees. 105-1537 for individual income tax.

Then print and file the. Description of Tax The property tax in North Carolina is a locally assessed tax collected by the counties. The current Federal Estate Tax Exemption for 2021 is 117 million per individual.

North carolina estate tax 2020. Even though north carolina has neither an estate tax or nor an inheritance tax the. NC K-1 Supplemental Schedule.

The new fee is effective for estates of decedents dying. The new fee is effective for estates of decedents. Department of Revenue does not send property tax bills or collect property.

Tax Rate for Estates and Trusts Trusts and estates are taxed at the rate levied in NC. North Carolina Department of Revenue. North Carolina Estate Sales Tag Sale Listed below are the cities of North Carolina that we serve.

North Carolina repealed its gift tax but you may still owe gift taxes at the federal level. The federal taxable income of the fiduciary is the starting point for preparing a North Carolina Income Tax Return for Estates and Trusts Form D-407 and requires the same additions and. Twenty-six counties had a revaluation in 2019 and 12 counties.

However you have an annual gift tax exclusion of 16000 for your 2022 returns.

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

How To Appeal Your Property Tax Assessment Bankrate

Lower Taxes And More To Know About Holly Ridge S 8 Million Budget

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Wilson County Government Great Opportunity To Learn About Business Personal Property Tax Next Week Join Crawford Bolton Wilson County Tax Department As Wilson County Government Wants To Help You Understand What

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Proposed Hope Mills Budget Doesn T Raise Property Taxes

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Madison County Set For 2020 Property Tax Reval Amid Real Estate Boom

Locust Property Tax To Remain At 36 Cents Rate For 24th Consecutive Year The Stanly News Press The Stanly News Press

Union County Government Beware A Union County Resident Received A Letter Like This In The Mail Claiming To Be From Union County And Stating Their Property Will Be Seized Due To

Wake County Nc Property Tax Calculator Smartasset

Guilford County Tax Department Guilford County Nc

County Nc House S Property Tax Deferment Bill Could Mean Loss Of Millions For Local Governments