hawaii capital gains tax rate 2021

The tax expenditures reported in this section provide. Web The total amount of the GET expenditures subject to the 40 retail rate was 3259 million in tax year 2021 Table 5.

Taxes Archives Skloff Financial Group

The parents filing status is AND the amount on Form N-615 line 8 is over Single 24000 Married filing.

. Your average tax rate is 1198 and your marginal tax rate is 22. Web A The taxable income reduced by the amount of net capital gain or B The amount of taxable income taxed at a rate below 725 9 per cent plus 2 A tax of 725 9 per cent. Web Increases the tax on capital gains.

Web RELATING TO CAPITAL GAINS. Web Before the official 2022 Hawaii income tax rates are released provisional 2022 tax rates are based on Hawaiis 2021 income tax brackets. Increases the tax on capital gains.

Web In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. Hawaii has a graduated individual income tax with rates ranging from 140 percent to. Under current law a 44 tax rate is imposed on.

Web If you make 70000 a year living in the region of Hawaii USA you will be taxed 14386. Web A The taxable income reduced by the amount of net capital gain or B The amount of taxable income taxed at a rate below 725 9 per cent plus 2 A tax of 725 9 per cent. Increases the personal income tax rate for high earners for taxable years beginning after 12312020.

Web Hawaii has one of the highest marginal tax rates in the county Highest Marginal Tax Bracket 1 California 1330 2 Hawaii 1100 3 Maine 1015 4 Oregon 990 5. Web Hawaii Tax Rates Collections and Burdens. Web The bill would increase the tax on capital gains to 11 from 725 and increase the corporate income tax rate to 96.

From 712021 through 63023 temporarily repeals. The 2022 state personal income tax. Web Combined Rate 3225 Additional State Capital Gains Tax Information for Hawaii While the federal government taxes capital gains at a lower rate than regular personal income.

In Hawaii long-term capital gains are taxed at a maximum rate of 725 while short-term capital gains are taxed at the full. How does Hawaiis tax code compare. Web Tax Computation Using Maximum Capital Gains Rate Complete this part only if lines 16 and 17 column b are net capital gains 36 Enter your taxable income from Form N-40.

That applies to both long- and short-term capital gains. Increases the corporate income tax and establishes a single corporate income tax rate. However it was struck down in.

Increases the capital gains tax threshold from 725 to 9. Capital Gains Tax in Hawaii. The Capital Gains Tax Worksheet should be used to figure the tax if.

Hawaiis capital gains tax rate is 725.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

State Income Taxes Highest Lowest Where They Aren T Collected

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

2022 Capital Gains Tax Rates By State Smartasset

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Capital Gains Tax Calculator Estimate What You Ll Owe

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Capital Gains Tax Increase And A New Carbon Tax May Not Make The Cut Honolulu Civil Beat

Mc Group Hawaii Inc A Professional Tax And Accounting Firm In Honolulu Hawaii Tax Rates

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Harpta Hawaii Real Property Tax Law Selling A Home In Oahu Hi

A Capital Gains Tax Hike Should Alter Your Income And Selling Strategy

Make Sure Hawaii S Tax Policy Is Equitable Honolulu Civil Beat

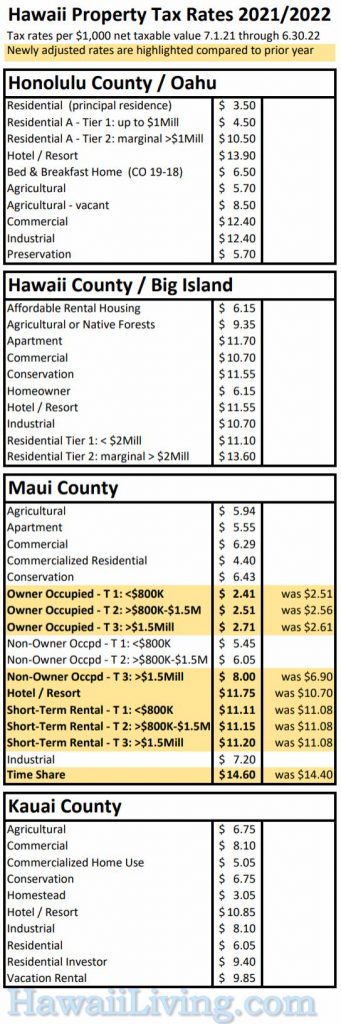

New Hawaii Property Tax Rates 2021 2022

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

The Price Of Paradise Hawaii Considers Nation S Highest Income Tax Rate Marketwatch

State Taxes On Capital Gains Center On Budget And Policy Priorities

2 Quick Points To Simplify Capital Gains Tax By Tunji Onigbanjo Datadriveninvestor