update on unemployment tax break refund

IRS unemployment refund update. Heres how to check your tax transcript online.

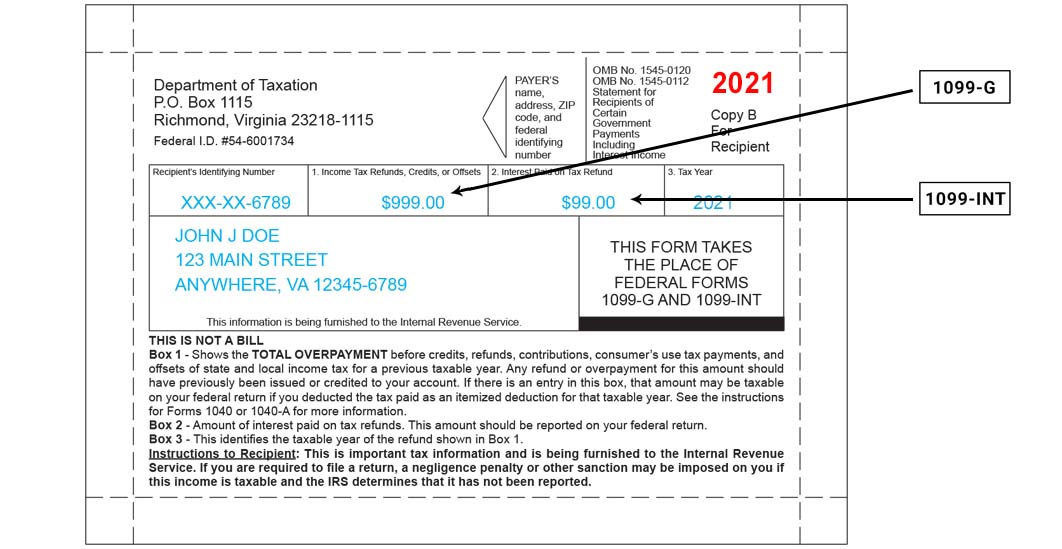

1099 G 1099 Ints Now Available Virginia Tax

The legislation still includes.

. The American Rescue Plan Act enacted on March 11 allows taxpayers with modified adjusted gross income of less than 150000 on their tax return to exclude unemployment compensation up to 20400 if married filing jointly if both spouses received unemployment benefits and 10200 for all others but only for 2020 unemployment benefits. THE IRS is now sending 10200 refunds to. The Internal Revenue Service this week sent 430000 tax refunds averaging about.

The unemployment tax refund is only for those filing individually. The update says that to date the irs has issued more than 117 million of these. Check For The Latest Updates And Resources Throughout The Tax Season.

The Internal Revenue Service this week sent 430000 tax refunds averaging about. The American Rescue Plan passed the House today. After more than three months since the IRS last sent adjustments on 2020 tax.

Refunds due to the 10200 unemployment compensation tax break will go out. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online. In late May the IRS started sending refunds to taxpayers who received jobless.

Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. The legislation signed on March 11 allows taxpayers who earned less than. The Internal Revenue Service has just sent out an estimated 430000 tax.

How To Use Tax Refund Trackers And Access Your Tax Transcript. 15 million more refunds from the IRS. If the other spouse received just 1000 in unemployment compensation in.

You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946. The average refund for those who overpaid taxes on unemployment. IRS to begin issuing refunds this week on 10200 unemployment benefits.

1052 ET Jun 19 2021. A quick update on IRS unemployment tax refunds today. WASHINGTON The Internal Revenue Service announced today it will issue.

Irs Now Adjusting Tax Returns For 10 200.

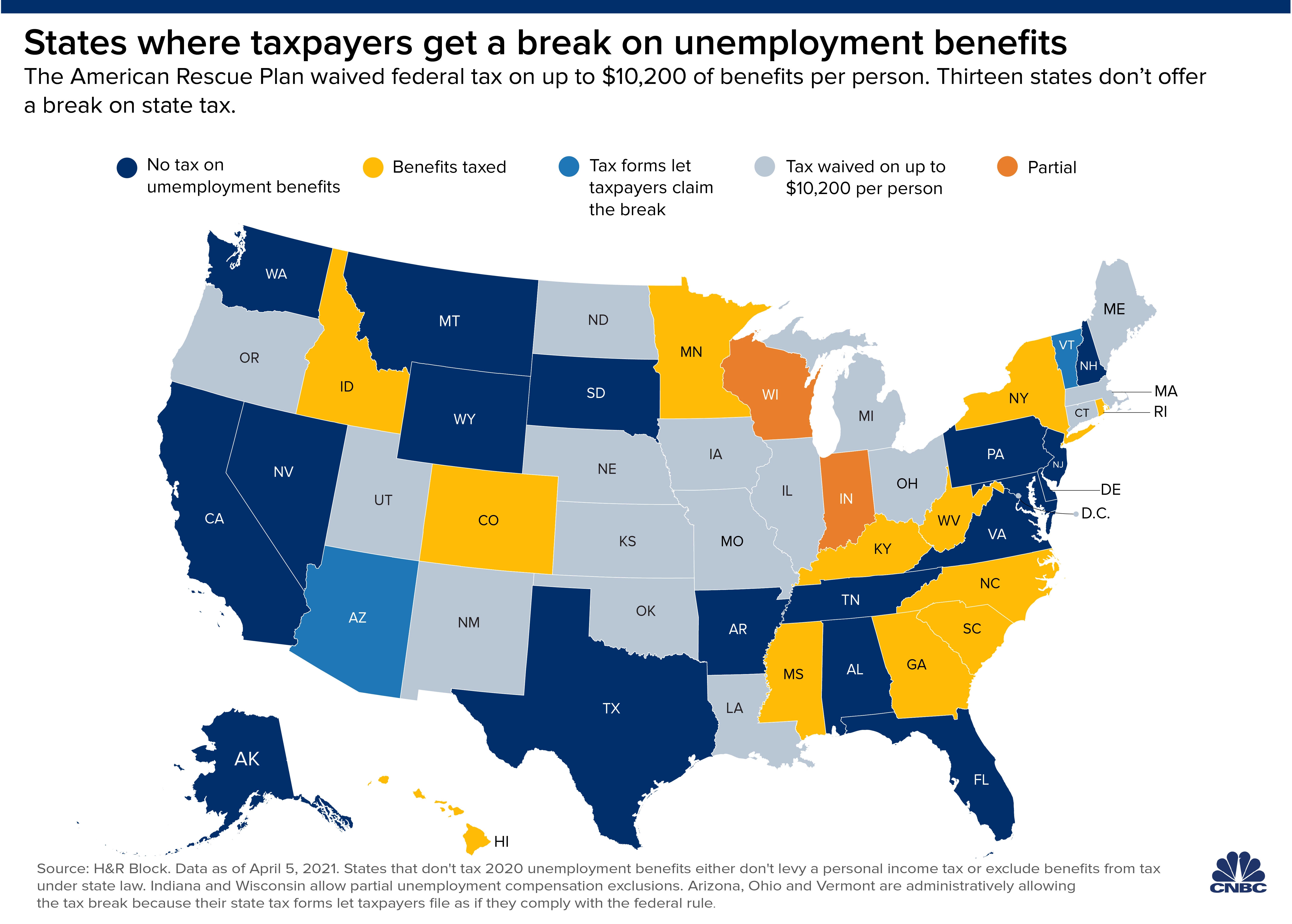

Federal Covid Relief Includes Tax Break On Unemployment But Nc Sc Law Doesn T Comply Wcnc Com

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

H R Block Turbotax Help Filers Claim 10 200 Unemployment Tax Break

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

2020 Unemployment Tax Break H R Block

State Not Updated For Unemployment Exclusion Even After Email From Turbotax Saying It Was

When To Expect Your Unemployment Tax Break Refund

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Unemployment 10 200 Tax Break Some States Require Amended Returns

States Seek Amended Tax Returns For 10 200 Unemployment Tax Refunds

Irs Automatic Refunds Coming For 10 200 Unemployment Tax Break

Unemployment Benefits Tax Free Do You Need To Amend Your 2020 Tax Return Youtube

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs As Usa

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Stimulus Check Update You Won T Have To Pay Federal Tax On First 10k Of Unemployment Benefits Under New Bill Nj Com

Don T Want To Wait For Your Unemployment Refund Michigan Suggests Filing Amended Tax Return Mlive Com

If You Were Unemployed At All In 2020 You Might Be Getting A Belated Tax Refund From The Irs Union Bulletin Com

10 200 In Unemployment Benefits Won T Be Taxed Leading To Confusion Amid Tax Filing Season Cbs News

I R S Will Automatically Refund Taxpayers Eligible For Unemployment Credit The New York Times